When to Be Impatient

Entrepreneurs and Angel Investors often rely on their gut or their experience. But sometimes a little math can help Angels and Entrepreneurs make better decisions.

One case in point is how to trade off the size of an exit and how long it takes to get there. For example, how would you rank the following outcomes:

a) A 2x exit in 3 years (ie, you invest $x now and receive twice that three years from now)

b) A 3x exit in 5 years

c) A 6x exit in 8 years

d) A 9x exit in 10 years

e) A 90x exit in 20 years

Obviously, an exit which delivers 90 times the initial amount invested sounds a lot more exciting than any deal with a single-digit multiple. And many VCs would note that option e) is the only one on the list which “returns the fund,” guaranteeing that an entire portfolio would deliver attractive returns. But 20 years is a very long time to wait — and definitely too long for most VCs. How does outcome e) really compare to the choices where investors get a lower multiple much sooner?

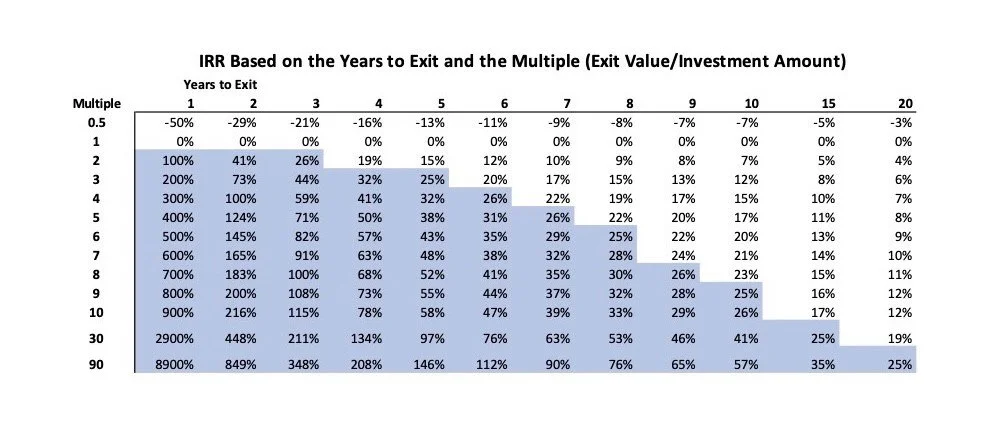

This is a situation where math can help. And the math here simply requires calculating the Internal Rate of Return (IRR) for each scenario. Assuming each deal has a single initial investment and a single exit, here are the IRRs for a variety of multiples and years to exit:

All of the deals with at least a 25% annual IRR are shaded in blue. This makes it easy to see that a 2x exit in 3 years produces a 26% IRR.

Now check out the results for options b), c), d), and e). You will discover that they all have IRRs of 25% — which is a great return, but not quite as attractive as option a). Surprisingly, the outcome with the highest annual return among these options is the deal which “just” doubles your money in 3 years.

Of course, investments which have the potential to deliver high multiples can deliver sky-high returns. For example, a company which has a 90x exit in 3 years would yield a 348% annual IRR. That’s an incredible outcome, and it would make the career of any Entrepreneur. But very, very few deals produce returns of that magnitude in such a short span of time.

So how should Angels and Founders use the IRR math to make better decisions?

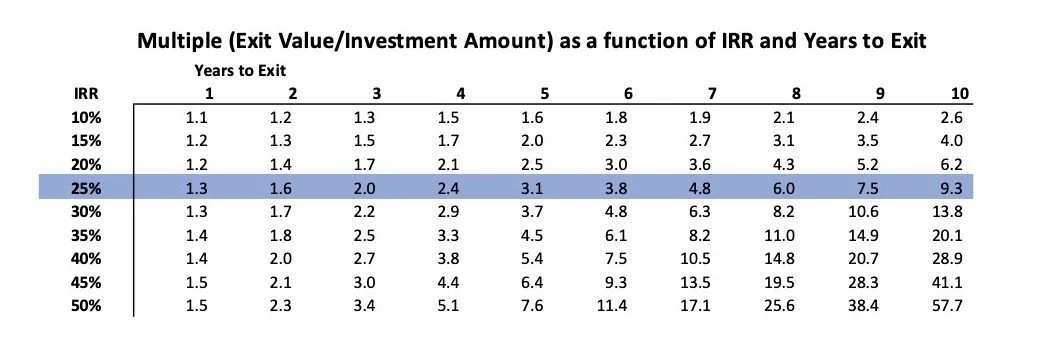

One way is to set a “Required Rate of Return” for deals at a specific IRR level. Different investors will have different views of the IRR threshold. The table below displays the Multiple a given investment will yield at a given IRR over a given number of years:

This information can help determine what a company needs to do to reach a given Required Rate of Return. The table highlights a 25% IRR target, which is a threshold some Angels and VCs use.

Consider a company that raised a round three years ago and now gets an offer for a 2x exit — but also has investors interested in a follow-on round that could allow the company to scale. Which path should the company choose? The current exit would lock in a 25% return. So doing the follow-on only makes sense if it can produce a higher IRR. If the company is confident that the follow-on round would spur enough growth to warrant at least a 3x multiple (adjusted for dilution) within the next year, that would translate into over a 30% IRR for investors and the follow-on is the better choice. But if it takes the company two years or more to get to a 3x exit, the resulting IRR will be below 25% and it makes sense to exit now.

The key take-away for Angel Investors is that a modest multiple can produce very strong returns if the exit happens quickly enough. And here are some of the implications of this finding:

Understanding the motivations of a company’s founders and their exit timeline should be a top priority for Angel Investors

Companies positioning themselves for an exit in the near term may deliver higher rates of return than companies with bigger business potential but longer timelines

Linking the exit multiple to the IRR can help Angel Investors and Entrepreneurs make better strategic decisions

In sum, they say that patience is a virtue. But Entrepreneurs and Angels should know when it pays to be impatient.

-by Seth Masters, Board Member of New York Angels