Personality Traits of Female Entrepreneurs Who Have Successfully Achieved Seed Funding

According to a study conducted of the eight top-referenced entrepreneurship journals, research on women who started businesses was “vastly understudied” averaging “6–7 percent of the total publications since 1994.” (de Bruin, Brush, & Welter, 2006, p. 585).

Seeing a need, New York Angels member, Nathan Sambul, focused his doctoral dissertation on women entrepreneurs. Below are excerpts from his dissertation. Nathan provides strategic marketing and communication services, with expertise in market strategy and research, advertising, public relations, and consumer behavior. He holds a Doctor of Business Administration degree from the International School of Management in Paris, where he now teaches, and where he completed his dissertation. It is a 250-page paper, and the summary below is a top-line overview of the findings. The complete dissertation can be provided upon request.

A dissertation on successful female entrepreneurs who obtained seed funding:

This document examines the personality traits of female entrepreneurs who have successfully obtained seed funding from accredited investors who are members of a leading angel investment group. These angel investors are considered highly sophisticated and prudent, and only fund approximately 2.5 percent of the opportunities presented to them.

In particular, female entrepreneurs have a difficult time raising seed capital, thus limiting the growth of their start-ups. The participants in this survey were able to raise funds, and using two quantitative instruments — DISC and AQ (Adversity Quotient) Profile — five personality traits were examined: Dominance, Influence, Steadiness, Compliance, and Resilience. In addition, open-ended, semi-structured quantitative interviews were conducted that further illuminated the traits and how they are part of the participants’ characters.

Study population:

Nine female entrepreneurs, who had received seed funding from the New York Angles, agreed to be interviewed and to take the DISC and AQ Profile research surveys. The following is a snapshot of the demographics of this population.

44% (4/9) — 35–44 Years Old

56% (5/9) — MBA & PhD

56% (5/9) — Prior Entrepreneurial Experience

89% (8/9) — Software Arena

67% (6/9) — NYC Area

44% (4/9) — 5 Years in Business

44% (4/9) — 6–9 Employees

67% (6/9) — $500K — $3MM Past Year Revenue

78% (7/9) — $0 Net Profit in Prior Year

Personality traits used (DISC and AQ Instruments):

It is estimated that there are more than 2,000 personality tests on the market, many of them do not pass muster with regards to reliability and/or validity. DISC and AQ Profile are well established personality tests that have been used by governments, corporations, and educational institutions. Here is a summary of what each component part demonstrates:

· Dominance: Drive, Determination, Self-reliant, Independent

· Influence: Self-confident, Expressive, Sociable, Enthusiastic

· Steadiness: Patient, Persistent, Stable, Thoughtful

· Compliance: Rules-oriented, Organized, Precise, Cautious

· Resilience (measured by Adversity Quotient): Tenacity, Endurance, Optimistic, Influence

Findings:

Using a combination of quantitative and qualitative research, a number of key observations were able to be deduced.

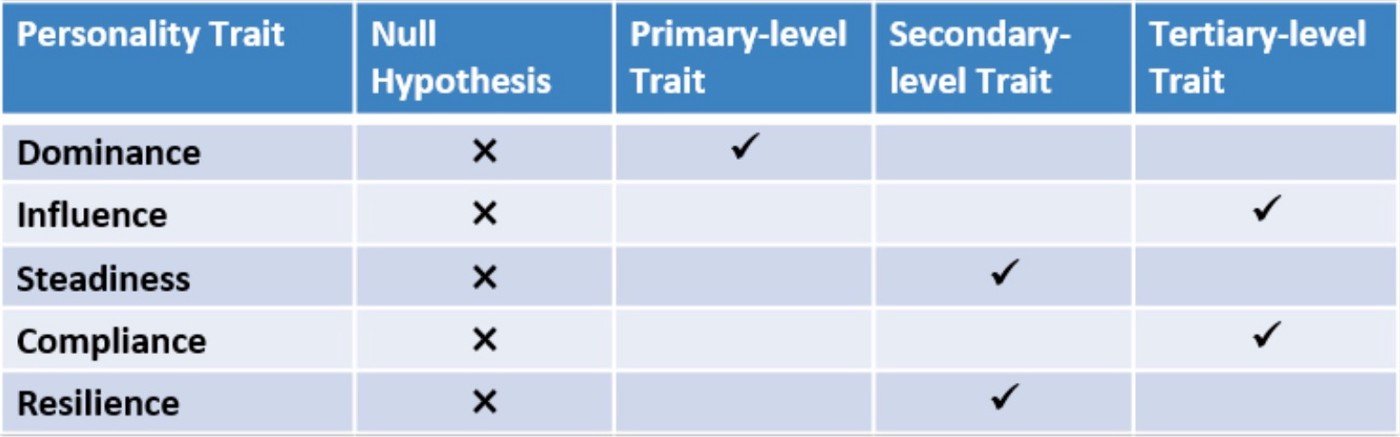

First, regarding the leading thrust of the paper — Personality Traits — the null hypothesis for each of the five traits under review (H1-Dominance; H2-Influence; H3-Steadiness; H4- Compliance; H5-Resilience) were rejected:

H1: Dominance is not a personality trait of female entrepreneurs who have achieved seed funding.

H2: Influence is not a personality trait of female entrepreneurs who have achieved seed funding.

H3: Steadiness is not a personality trait of female entrepreneurs who have achieved seed funding.

H4: Compliance is not a personality trait of female entrepreneurs who have achieved seed funding.

H5: Resilience is not a personality trait of female entrepreneurs who have achieved seed funding.

Instead, each of the five traits was part of the personality makeup of the participants; however, not all of them at the same level of strength. Using Allport’s structure of a tri-level hierarchy as a model (Cherry, The trait theory of personality, 2018), each trait was assigned a different level of influence.

H1A: Dominance is a primary-level personality trait of female entrepreneurs who have achieved seed funding.

H2C: Influence is a tertiary-level personality trait of female entrepreneurs who have achieved seed funding.

H3B: Steadiness is a secondary-level personality trait of female entrepreneurs who have achieved seed funding.

H4C: Compliance is a tertiary-level personality trait of female entrepreneurs who have achieved seed funding.

H5B: Resilience is a secondary-level personality trait of female entrepreneurs who have achieved seed funding.

The following table is a visual summary of the findings from the research above.

Over the years, the author has conducted many surveys, and insists that before conducting a major survey, a smaller version be administered to verify the approach. It is recommended that future researchers replicate this work on a much larger population of female entrepreneurs who have obtained seed funding to verify or refute the results in this document.

In subsequent testing, a wider selection of women should be used. This report had a concentration of participants in the software field. However, in reality there are many other industries in which women have created new companies and have sought funding. Some of these ventures include companies dealing with television programming, diabetes monitoring systems, real estate mortgages, educational institutions, and consumer goods, such as folding bicycle helmets.

Besides expanding the industry segment of the research, future studies should also include women from a wider geographic range. There are angel groups in virtually every state. While fewer applicants may apply for seed money, it would be interesting to learn if women in different geographic areas project the same or different personality traits.

One last anecdotal observation: Having sat through scores of pitches by entrepreneurs seeking funds and being a board member of companies, both in Europe and in the United States, there appears to be one common thread. Investors focus heavily on the personality of the entrepreneur.

More often than not, investors want to see and work with an entrepreneur that has a clear vision of the direction and goals of her company, i.e., Dominance. She should have a competitive attitude with a sense of personal responsibility. After all, the investors and the board will turn to her for candid assessments, with the expectation that decisive actions will take place.

Recognizing that obstacles and setbacks will occur, investors want an entrepreneur who can rationally analyze the situation, develop an appropriate solution, and mobilize the resources necessary to overcome the conditions that she faces, i.e., Resilience.

Success for a start-up means being able to play a long game. While investors want to see a return on their investments — and more often than not, the sooner the better — they realize that it will take years. Entrepreneurs that demonstrate persistence and dependability gain the respect of investors, i.e., Steadiness.

While Influence, the ability to communicate well, and Compliance, being detail oriented, will help any entrepreneur, to the future female entrepreneurs who may read this report, do not hesitate to project the traits of Dominance, Resilience, and Steadiness.