Follow-On Lessons

Follow-On Lessons

Angel investors often define themselves by the round they invest in — as a “Seed Investor” for example. But most successful startups will require several rounds of capital-raising. And one of the benefits of investing in a seed round is the pro-rata right to participate in later rounds.

How can Angel investors assess whether and how much to invest when a portfolio company has a follow-on round? And what broader lessons does that entail?

Let’s start with a scenario where a startup had the following funding pattern:

a) Initially, a preferred equity seed round at $1 per share

b) After two more years, a preferred equity A round at $3 per share

c) After two more years, a preferred equity B round at $4.5 per share

d) After two more years, a preferred equity C round at $5 per share

e) After two more years, an exit at $10 per share

This is clearly a very simple example, since all the rounds are preferred equity. Also, we are just focusing on the share price for each round, which incorporates the dilution impact at each stage of the process.

And the share price is all we need to see that the seed investors in this startup had a great outcome: each share they bought for $1 steadily grew in value in each subsequent round and ultimately returned $10, for a 10x multiple at the exit. By contrast, investors in the C round paid $5 for each of their shares, so their multiple was just 2x.

But the seed investors also needed to wait 8 years for their exit, whereas the C round investors cashed out in just 2 years. So which round actually delivered the best returns?

Fortunately, a little math provides the answer:

With this funding pattern, the Internal Rate of Return (IRR) for the seed investors was 33%, which is a very good return. By contrast investors in both the A round and the B round received more modest 22% returns. And the big winners were the C round investors, with a 41% IRR.

The first lesson we can learn from this example is even when you’re investing in the same company, each round is a discrete investment with a return profile which depends on the multiple and the years held for investors in that specific round. In this case, even though they had the lowest multiple, the C round investors had the best IRR because their holding period was so short.

But what would have happened if rather than $10, the exit share price was just $6? The differences between this scenario and the first one are highlighted in yellow below:

Obviously, the lower exit price means lower multiples and lower IRRs for investors in every round compared to Scenario 1. All the multiples decline by 40%, since the exit share price is 40% lower.

But the IRR impact is more complex. For C round investors, the IRR collapses from 41% to 10%, a drop of more than 75%. B round investors are hit almost as hard, with their IRR falling from 22% to 7%. But the Seed investors experience a more modest decline from 33% to 25%.

The second key lesson to draw from this example is that the sensitivity to exit prices varies considerably for the investors in different rounds. Generally, later rounds are far more leveraged to the exit price. In this example, the 40% drop in the multiple had over three times the impact on the returns for C round investors compared to Seed investors. So the investment risks are different in early vs later rounds.

Of course, the key business risks also shift over the life cycle of a startup: for example, the initial hurdles for a startup could be launching a product and demonstrating product-market fit, and later on the company would need to focus on growth and margins. But in addition to succeeding as a business, Entrepreneurs and Angels should recognize that their biggest risk as early investors is whether there will be an exit; whereas if a company makes it to a C round or beyond, the biggest investment risk for the investors in later rounds is the size of the exit.

The third key lesson follows from the first two. If investing in different rounds of the same company have structurally different return and risk profiles, then follow-on investments can diversify an Angel portfolio.

This is a very big deal, because most Angel portfolios are overly concentrated. But it’s more than that: Angels are often wary of investing in follow-ons because they fear that “doubling down” on a company is increasing their risk.

In fact, follow-ons can diversify risk. And this is why pro-rata investment rights are very important for Angel investors.

That said, it isn’t always a good idea to participate in every round. In Scenario 2, the seed investors enjoyed the highest IRR. And the B round delivered the lowest returns in both scenarios above. So how should Angels invested in a company which is doing a follow-on round decide when to exercise their follow-on rights?

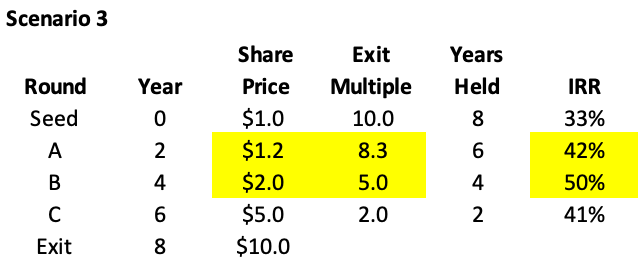

A final scenario can shed light on this question, and again the differences from Scenario 1 are highlighted in yellow:

In this Scenario 3, the B round has the best returns of all (quite a turnaround!) and the A round is next best. Most important, the investors at every stage of the process should be delighted with their return. So this scenario illustrates the perfect fund raising outcome for all parties: the Entrepreneurs, the early investors, and the follow-on investors. And what made this miraculous math work out?

When you compare Scenario 3 with Scenario 1, the key difference is that in Scenario 3 the share price is lower for the A and B rounds.

This is the fourth lesson: assuming a successful exit, investors and Entrepreneurs benefit when the share price stays relatively low throughout the early rounds.

Yes, most Entrepreneurs and Angels will find this idea to be very counterintuitive. Many Entrepreneurs and Angel investors “mark to market” and view a higher valuation as a good thing because it means their holdings are “worth more”. But actually a high price is only beneficial to Angel investors or Entrepreneurs if they are selling their shares in that round.

In most follow-ons, the investor is either buying shares or standing pat. So most of the time, lower share prices in early rounds are good for investors.

Also, if the valuation gets too expensive in the early rounds, it becomes more likely that the company will subsequently need a recap or down round to attract new capital. Down rounds are designed to dilute almost all of the shareholdings of Entrepreneurs and early investors. A company may recover after a down round, but virtually all the benefits of that recovery will go to the investors in the down round and subsequent rounds.

Entrepreneurs may see themselves as being in a different position than Angels because “low valuation means more dilution.” Actually, the dilution impact is usually similar for Entrepreneurs and Angel investors in early rounds. And by focusing on the share price, the scenarios above incorporate the effect of dilution. But in those situations where the Entrepreneurs’ stake is getting overly diluted, Entrepreneurs can be awarded stock options to shore up their position. And that makes the Entrepreneurs effectively leveraged buyers of the stock — which again means that a lower valuation is better for them.

Of course, this brief discussion only scratches the surface of what can happen in follow-on rounds. Many rounds are convertible notes or other instruments which do not have a defined share price. And we’ve only considered three of the many possible scenarios.

Still, there are some clear and surprising take-aways for Angel Investors and Entrepreneurs:

Each investment round for a given startup is a distinct, separate investment opportunity

The key risk for investors in early rounds is whether there will be an exit, whereas later investors are more levered to the size of the exit

Investing in follow-on rounds can diversify risk in Angel portfolios, even when it’s the same underlying company

High valuations in the early rounds tend to be counterproductive. The time when it really pays to focus on a high share price is at the exit

In sum, investment success comes down to buying low and selling high. But that’s harder than it sounds.

~ written by Seth Masters, NYA Board Member