2023 IN REVIEW: NYA MEMBER REFLECTIONS

Similar to many other angel groups, investments by members of the New York Angels slowed in 2023. We asked our colleagues why they thought that this was the case and how this related to their own view of the market in 2023. Their answers were very interesting, describing the year with words like “challenging”, “slow”, “tough” and “mixed”. However, more surprisingly, words like “optimistic” and even “great” also appeared.

NYA Members thoughts are summarized below.

It’s the Economy Stupid

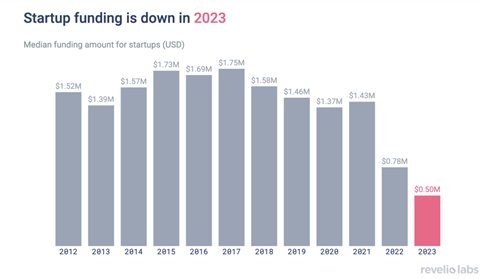

Not surprisingly, macroeconomic considerations dominated investors’ responses. Ongoing uncertainty about the economy, interest rate hikes, global conflicts and the aftermath of bank failures have made the investment climate in 2023 increasingly uncertain. The slowdown in funding has been widely reported. Global Data states that VC funding in the USA dropped by a massive 45.6% in the first three quarters of 2023, which has had a significant ripple-effect on early-stage investments, especially for companies raising later-stage rounds. The amount that individual companies were able to raise had significantly reduced in 2023, as demonstrated by Revello Labs in the graph below.

Revelio Labs - “Startup Funding is Drying up as the AI Revolution Begins”

Our members are well aware of the impact of this trend and its impact on the companies that we see every month. As Seth Masters noted:

“2023 was the year when early-stage VCs retrenched (after the funding boom from 2019-2022). Existing NYA investments have consequently needed more help for follow-ons.”

And Bill Pertusi agreed:

“Macro considerations continue to dominate in my view.”

While Criag Frischling added:

“It is not surprising that our patterns mirror the broader marketplace.”

No Interest in Startups?

The net result of the macroeconomic environment has been to suppress funding in early-stage companies, as there are clear alternative investment activities. As Michael Hutner explained,

“(The macroeconomic environment has) …changed the game on whether I want to hold onto cash with higher rates or invest more for potentially higher return with higher risk.”

Barbara Moore spelt out why this is the case:

“Today’s higher interest rates, yield lower NPVs of future cash flows even before adjustment for the considerable risk of early-stage investments.”

While Donna Redel summarized the thoughts of many in a very succinct way:

“Rising interest rates and stock market returns make investing less attractive”.

Lack Of Activity?

The tightening of VC funding and the macroeconomic conditions have negatively impacted the investments made. The vast majority of our members claimed to have been less active, with statements like:

“In 2023, I've made fewer investments than in prior years.”

“2023 has been a year to hang on.”

However, Chairman, Mark Schneider, cautioned that year-over-year comparisons could be misleading:

“We are coming off an unusually high year (in 2022),”

However, very few reported zero activity. For example, Tom Blum stated that while his appetite for new investments was not as strong, he has been,

“…making a lot of follow-on investments”

Elaine Gilde explained why this was also the case for her:

“Many existing rounds are getting reopened at flat valuations.”

And this was echoed by Dan Zitting, who emphasized reducing risk by,

“…re-raising on previous round terms but with improved value to customers and traction.”

A number of members thought that there may be other, non-economic factors impacting levels of activity. Michael Costa suggested that investors are still experiencing a post-lockdown hangover:

“Members primarily invest on the strength of founders. With limited in person exposure to founders in 2023, new investment has thus been muted.”

Craig Frischling thought that the group was seeing fewer companies that profited from the "COVID economy", or the subsequent economic rebound. While Barbara Moore suggested that the slowdown could be part of a natural investment cycle:

“Many angels experienced strong exits in 2021 andearly 2022. These angels may now be waiting …before diving into new investments.”

Exits (of the Wrong Kind)

As Chairman Emeritus Brian Cohen likes to say, “Angels are in the exits business”, and while most of the focus in 2023 was on investing in new companies, the aforementioned trends also negatively impacted later-stage companies. Based upon the comments from our members, this year more companies went out of business than achieved a good outcome. One member commented:

“A couple of my portfolio companies didn’t make it. Both were victims of the economy and a tightening of later-round funding.”

And another stated:

“Some of my investments made in the 2019-22 period hit roadblocks in 2023, even after highly successful Series A and/or B.”

While another noted:

“A number of my past investments are having problems.”

But some investors did report more successful outcomes:

“One good exit, four up rounds, but several companies struggling.”

Concern Over Valuations

Investing at such an early stage, Angels are very sensitive to company valuations with relatively small variances in valuation translating to much larger gain differences on exit. Consequently, the subject of valuations in 2023 was a hot topic. Many members still believe that valuations are too high, as Mark Schneider believes:

“Valuations still haven't come down to reflect the new realities.”

And Michael Costa also noted:

“Many founders have not reset expectations to reflect current investors risk/reward appetite and are still pursuing 2021 valuations and structures.”

Simon Hopkins suggested that this was not necessarily true across all areas:

“Valuations in "hot" areas are still too high for me, but I do see them normalizing in other areas.”

While some angels, like Brian Stempeck, did see a difference in 2023:

“Valuations have become more realistic”.

Barbara Moore explained why she believes that valuations still have further to fall:

“Valuations at the early stage should have adjusted commensurately with the write-downs we’ve seen institutional investors take in much later stage companies.”

What’s a Founder to Do?

Given the difficult funding situation, many members had advice for early-stage companies. This nearly always urged them to shift their focus to profitability, cutting non-essential costs and emphasizing revenue generation. As Barbara Moore stated:

“Current challenging fundraising markets are educating founders on multiple fronts. Streamlined expenses, focused product choices and follow-ons at static valuations.”

Mark Schneider also highlighted the importance of companies raising sufficient funds when they have the chance, stating what happens when this is not the case:

“We see a lot of fundraising requests which are insufficient to get to a bump up in valuation, (leading to) the inevitable flat round raise when the company runs dry.”

Dan Zitting noted that despite the difficulties in 2023, the survival of the fittest companies would benefit investors:

“I think the entrepreneurs successfully navigating the market's choppy waters are becoming much more savvy (and realistic) business leaders for the long term.”

And Tom Hirschfeld shared this note of optimism, highlighting the importance of the team:

“Even in tough markets like this, good teams will rise to the top.”

Not All Doom and Gloom

It is often quoted that many successful companies (like Microsoft and Airbnb) were founded in a tough economic climate. Despite the current difficult environment, and the difficulties that dominated in the responses, our members are still looking out for the next unicorn. Consequently, there were also signs of optimism from many investors. As

Dan Zitting stated:

“I am quite optimistic about 2023 in terms of generating longer term returns.”

And Brian Stempeck added:

“While I'm worried about the macroeconomy… I've seen a lot of great opportunities this year.”

Anthony Gellert was also optimistic, and suggested why:

“2023 was great. Angels had the upper hand.”

And finally, Seth Masters summed up the feeling of many of the respondents about 2023, with a note of optimism for the future:

“So, it’s a tough environment that contains the promise of real opportunities moving forward.”

We will see what 2024 brings…